Chuck's Corner

Tips, Advice, CRE Stories & More

With over 17 years of experience in the Lawton residential and commercial real estate industry, I have been passionately serving clients since 2006. As a dedicated family man with lots of grandchildren to spoil, I understand the importance of finding you the perfect space or investment that suits your unique needs. I take great pride and satisfaction in being an active member of the community, always striving to make a positive impact. When I’m not helping clients with their real estate goals, you can find me exploring the great outdoors, enjoying all that nature has to offer. I believe that every client deserves exceptional service, tailored solutions, and a friendly professional approach. Let’s work together to find the ideal commercial real estate solution for you. I look forward to the opportunity to discuss your commercial interest and working with you!

What we do as CRE professionals transcends the properties themselves. We change communities and we change lives. Here I will help you understand the journey, give you advice and share my stories. I won't call myself an expert, but I might know just a few things.

September 7, 2023:

Residential VS

Commercial Real Estate

Before entering commercial real estate, I often thought of the many nuances between residential and commercial transactions and how the clients differ significantly in motivation and in terms of wealth generation.

Residential real estate refers to properties that are primarily designed and used for individuals or families to live in. These can include single-family homes, apartments, condominiums, and townhouses. Residential properties are typically purchased by individuals for personal use or as investment properties to generate rental income. The main goal of residential real estate is to provide a comfortable and safe living space for individuals and families. The market for residential real estate is driven by factors such as housing demand, population growth, employment rates, and personal preferences. The value of residential properties is often influenced by the condition of the property, location, and the overall state of the housing market.

Commercial real estate, on the other hand, refers to properties that are used for business purposes. This can include office buildings, retail spaces, industrial properties, hotels, and warehouses. Commercial real estate is typically purchased by businesses or investors with the intention of generating income through leasing or selling the property. The value of commercial properties is primarily driven by their income potential. Factors such as location, accessibility, surrounding businesses, and market demand play a crucial role in determining the value of commercial real estate. The commercial real estate market is often influenced by economic conditions, business trends, and the overall demand for office and retail spaces. Additionally, commercial real estate offers more diverse investment opportunities and greater passive income when compared to residential real estate.

This diversity of commercial real estate allows investors to choose from a range of opportunities based on their preferences and market conditions. In contrast, residential real estate typically revolves around individual homes or multifamily residential buildings. Commercial real estate is the art of putting together business deals that make sense and are good sound investments for the client.

This information is important to you if you want to begin or continue investing in the commercial market. Commercial real estate generally offers a higher potential for wealth generation due to its income-generating nature, while residential real estate focuses more on personal living and value appreciation. The data used for analysis also differs, with commercial real estate emphasizing financial metrics and residential real estate focusing on factors related to housing demand and market trends. Both sectors have unique aspects and considerations for investors and professionals.

September 22, 2023:

Gathering the Tools of

Commercial Investing

In last week’s article, I explained the differences between investing in your own home and investing in commercial real estate. Now that you understand the differences between the two types of investments. Navigating this complex market requires careful consideration and detailed planning. In this article, we will explore three essential steps to help you embark on a successful commercial real estate investment journey. Whether you are a seasoned investor or just starting, these three steps will provide valuable insights and actional tips to make informed decisions and maximize your returns. Investing success begins with detailed learning and preparation.

Step one, is to educate yourself by reading books, attending seminars or webinars, and finding a commercial industry blog that interests you. As part of your education, you will learn that within the commercial market investors have choices on the types of investments available. Identify your personal investment goals; are you looking for long term cash flow, capital appreciation, or a combination of both? Clarifying these goals will help you make informed decisions. Commercial land is usually purchased as a speculative investment but requires little to no management. Industrial or retail properties generally attract long-term tenants and may require detailed management. Each type of commercial investment has unique characteristics, which I will address in a future article.

This next step in the journey is building the contacts that are important to your continuing education and in developing your strategy. It is essential to connect with professionals in the industry such as real estate agents, brokers, lenders, and experienced investors. Think of this as assembling your personal team of authorities for all your current and future investments. A good example of this is finding a lender with experience in commercial lending; not all lenders provide commercial financing. Additionally, commercial real estate investments often require significant capital, so a solid relationship with your lender is a must. They can assist you in researching different financing options such as traditional bank loans, private lenders, or partnerships.

Step number three takes your attained knowledge and your team of experts in finding a suitable property worthy of your investment. Now that you know how much you can afford to invest, you want to identify the markets that align with your investment goals. Whether you want to invest nationally or locally, look for areas with strong economic growth, population growth and favorable market conditions.

Remember, investing in commercial real estate requires patience, research, learning and assembling a team that you trust and that have your best interests. Each investment is unique, so it’s essential to adapt your approach based on market conditions and your specific goals. I will address finding suitable commercial investments which match your investment goals in my next article. Good luck and I wish you great success in your journey to becoming a successful commercial real estate investor!

October 10, 2023:

Finding Your Niche

in Commercial Investing

You completed forming your team, learning the market, and having the resources in-place to purchase your first commercial investment! The next step is deciding what type of commercial properties interest you. The first question I ask a potential client is what type of investment properties are they looking for? A seasoned investor will answer quickly and have personal experience and interest in the type of properties they are considering to purchase. Whereas a beginner will hesitate to indicate they are undecided or lack understanding of the pros and cons of each type of commercial investment. It is in this piece I will discuss how you determine a CAP rate and the uniqueness of a multi-family investment.

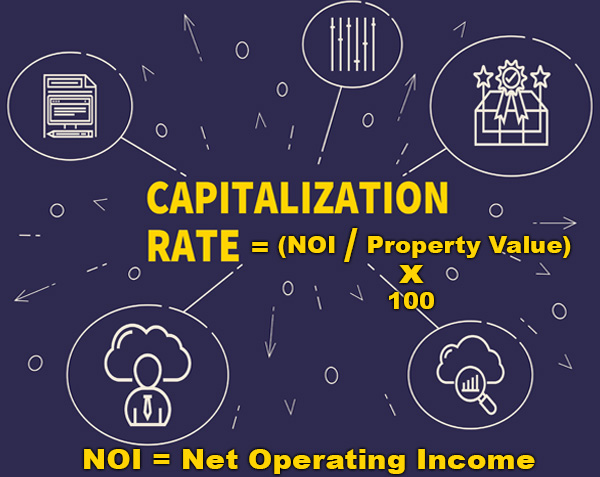

It is important to understand all categories can often overlap, as some properties may serve multiple purposes. Additionally, the location, size, amenities, and market demand can greatly influence the value and profitability of each type of commercial real estate and the goals of investing. Regardless of the category or type of property, you need to know how to determine the capitalization rate of the property that has your attention. To calculate the CAP rate. You divide the net operating income (NOI), by the property value, and multiply the result by 100 to convert it to a percentage. The formula is: Cap Rate = (NOI/property value) x 100. I will provide a CAP rate calculation in the next paragraph.

So, if you are looking at a multifamily property and the property generates an NOI of $175,000 and there is an appraisal on the property for $1,800,000, the CAP rate would be ($175,000/$1,800,000) x 100 = 9.72%. Real quickly, if you had to borrow from a lender today, your commercial rate will be between 8.75% - 9.50% and the best return you could hope for would be .0972%. You will want to be able to quickly determine CAP rate for any commercial property you are interested in except for commercial land.

I probably get more calls regarding multifamily properties than any other type of commercial investment and there is a reason. These properties cater to residential purposes and include apartment buildings, condominiums, townhouses, or other multi-unit complexes. It is true across the board, the larger the property, the more income it will generate. Albeit a larger complex requires resources such as on-site management, daily/deferred maintenance, and a proven accounting system to track your receipts and expenditures. The lease term for multi-families is usually one year, so turnover is a challenge, but can be mitigated by having a detailed wait list of future renters.

Me, personally I like multi-families because someone always needs a safe, secure, and sanitary place to live and 34.9% of the US population rent. Also, if you buy a duplex or apartment building the units are conveniently at one geographical location. If you are young and just starting to invest, or in the military you can purchase a duplex and up to a quad-plex using your VA eligibility, but you physically must live in one of the units. With any real estate investment, the successful leasing of your units is based on price, condition, and location. As an owner you can choose a location, but you can only affect pricing and condition to increase your bottom line. A seasoned multi-family manager can recommend improvements, regional rent rates and rental promotions to keep your units occupied. The more units, the more it is necessary to hire a management company.

Next week’s article will further explain the other types of investment properties and why they are appealing to commercial investors.

October 24, 2023:

Finding Your Niche

in Commercial

Investing Part II

In part I, we went over determining a Cap rate and discussing multi-family investments. To start this article, I want to address commercial entertainment and hospitality, industrial, retail and office spaces. I will start with entertainment and hospitality spaces because it is the least like retail and office properties and has a high initial investment commitment.

Hospitality and Entertainment spaces accommodate a variety of businesses, including restaurants, bars, theaters, event venues and hotels, offering a broad range of potential services. These types of properties have high rental income potential and may include diverse and national tenants, but they come with hidden expenses for the Owner, such as housekeeping, dining, and recreational facilities, etc. The cool thing about these types of properties are they are considered a “non-cyclical demand” meaning people seek entertainment and hospitality experiences, regardless of economic conditions, providing more stability for these spaces. Though, depending on if business is seasonal, you may experience seasonal fluctuations, leading to inconsistent revenue streams during certain periods. Also, businesses in the entertainment and hospitality sector may have higher turnover rates, as industry trends and consumer preferences change over time.

Although not necessary, an Investor looking for industrial space should have a good pulse of the local economy, local government, and zoning. Industrial real estate serves as facilities for manufacturing, production, storage, or distribution of goods. Here in Lawton, OK we have a significant shortfall of existing spaces between 2,000 to 30,000 sf., for all types of industrial businesses. This is a market deficit, and I would recommend that anyone that has the necessary capital look at purchasing or building these types of spaces. Be aware that these types of properties often require specific infrastructure and zoning approvals but can be very profitable.

The last two types of commercial properties I want to discuss today are office and retail spaces. Both these types of properties are similar in many ways. Both cater to specific retail or business requirements of the tenant and can come with very lucrative long-term leases. Both these types of properties are common in that they are usually located in a single building or plaza and that the Owner is charging a NNN lease. Triple NETS are built in the lease to be paid for by the tenant for the Owner and they include taxes, insurance, and common area maintenance (CAM). Landlords like NNN leases because it reduces the responsibilities for taxes, insurance and CAM and places these costs on the tenant, while freeing them from day-to-day management and associated costs. Another benefit to the owner is it provides predictable income since the tenants of these types of properties share the burden of the building’s NNN expenses. Furthermore, Landlords may be able to reduce their operating costs by having Tenants assume the NNN payments.

So, by now you can identify the various types of commercial real estate investments and maybe even have an idea on where to focus your attention. Next week’s Part III article will be on the purchasing of raw land. A raw land purchase probably comes with the most trepidation, because unless you have a crystal ball, you are speculating that some sort of office, retail, multifamily or entertainment business will make you money on your initial investment.

November 7, 2023:

Finding Your Niche

in Commercial

Investing Part III

At this juncture, we have discussed the many different types of commercial Investments and each one of these acquisitions started with the purchase of a piece of raw land. Purchasing a piece of dirt, I believe can be the most financially rewarding and at the same time the most speculative purchase one can make. A commercial investor may choose to concentrate on investing in raw land for several reasons.

Initially, raw land can offer potential for long-term appreciation in value. As population growth and urbanization continue, the demand for land can increase, leading to higher land prices over time.

Furthermore, investing in raw land can provide opportunities for development. Investors can choose to develop the land for various purposes, such as residential, commercial, or industrial projects, which can yield significant profits. Additionally, raw land investments often have lower holding costs compared to developed properties, as they generally lack buildings or infrastructure that require maintenance. This can lead to reduced expenses and potentially higher returns.

Investing in raw land can indeed be profitable, but it's important to consider various factors before making a decision. Here are a few points to consider:

- Location: The location of the raw land plays a crucial role in its potential profitability. Land in desirable areas with growing demand, such as near urban centers or in areas with planned development, tends to have higher potential for appreciation.

- Development potential: Assess the development potential of the land. Look into zoning regulations, permits, and any restrictions that may impact its future use. Land with the potential for residential, commercial, or industrial development can offer higher returns.

- Market conditions: Consider the current and projected market conditions for the area. Research trends, growth prospects, and demand for properties in the vicinity. A favorable market can significantly increase the value of your investment.

- Holding costs: Determine the expenses associated with holding the land, such as property taxes, maintenance, and any ongoing costs. These costs can impact the overall profitability of your investment.

- Long-term strategy: Investing in raw land often requires a long-term perspective. It may take time for the land to appreciate in value or for development opportunities to arise. Patience and a clear long-term strategy are crucial.

Lastly, investing in raw land allows investors to have more control over the development process and design of the property, which can provide creative freedom and the ability to align the investment with their specific goals and vision. However, it's important to note that investing in raw land also carries risks and challenges, such as zoning restrictions, environmental considerations, and the need for extensive due diligence. Remember that investing in raw land carries some level of risk, like any investment. It's essential to conduct thorough research, seek professional advice, and carefully evaluate the potential before making any investment decisions.

November 21, 2023:

Offer Accepted.

Due Diligence Time.

You have your advisory team of real estate professionals assembled and are now prepared to make an offer. So, working with your commercial agent, you have found something worthy of investing in. You submit a reasonable offer, and it is accepted. To determine a timeline for closing you must understand the difference between states like Oklahoma and Iowa and the rest of the country.

Iowa and Oklahoma are the only two surviving Abstract states, which means closing requires to have to have a physical abstract updated. This abstract method is considered the most complete, because of the steps that are taken to ensure there are no liens, blemishes, or title issues. It also has a detailed history of ownership. Since the updating cost the Seller money, the order to update an abstract is done once the due diligence period is concluded and you intend to proceed with the purchase. The abstract process can take between thirty to forty-five days after the due diligence to be updated and starts with an attorney’s opinion. The other forty-eight states use an abstract of title or chain of title, which is like purchasing an automobile in Oklahoma. The chain of title is, in essence, the history of a property’s ownership as it passes from one person to another. You will sometimes see the property title search itself referred to as the chain of title, as well. Like the Abstract, the chain of title provides a roadmap of how a piece of property has changed hands over the years. Verifying an unbroken chain of title is essential. It also gives you peace of mind when closing on a property, so you don’t have to worry about some unforeseen oversight or years-old claim muddying the ownership waters with your new commercial purchase. I recommend as a buyer you purchase title insurance, regardless of getting an Abstract or chain of title. This protects you from any title issues for the entire time you own the property.

You find a property that fits your criteria, and in your price range, and your offer is accepted. In a commercial real estate transaction, due diligence refers to the process of investigating and evaluating the property before finalizing the purchase or lease. It involves gathering relevant information and conducting a thorough analysis to assess the property's financial, legal, and physical aspects. Due diligence typically includes reviewing financial statements, mechanical systems, lease agreements, property surveys, zoning regulations, environmental assessments, and other relevant documents. The purpose is to identify any potential risks, liabilities, or discrepancies that may impact the decision-making process. Conducting due diligence helps ensure that the buyer or tenant is well-informed and can make an informed decision regarding the transaction.

The next article will focus on the benefits of having a property management team handle your investments.

December 5, 2023:

Do I Need

Property Management?

Determining whether you need rental management for your commercial investment involves considering several factors. Here are some key points to help you make an informed decision.

Financial considerations should be number one, because if you can’t afford professional management then the rest of these considerations would not apply. Evaluate the costs associated with rental management services. Typically, property management companies charge a percentage of the rental income or a fixed fee. Compare these costs against the potential benefits and your budget.

Time availability is critical to deciding on property management. As an owner of a commercial income producing property, you need to evaluate how much time you can dedicate to managing the property. Managing commercial rentals can be time-consuming, especially if you have other commitments. Rental management can help save you time and effort.

Location is another key factor. If your commercial property is located far from where you live or work, it may be challenging to manage it effectively. In such cases, rental management can provide local expertise and ensure smooth operations.

Expertise and experience are the business of a property manager, so assess your familiarity with property management, including legal requirements, tenant screening, lease agreements, maintenance, and marketing. If you lack experience or knowledge in these areas, rental management can offer professional guidance.

Scale of the investment or how large of an effort will managing this type of commercial investment be. Consider the size and complexity of your commercial investment. Large properties or multiple units may require more hands-on management. Rental management companies have the resources and systems to handle such demands efficiently.

Are you a people person? Well, you better be if you choose to self-manage, but If you prefer to maintain a certain level of distance from tenants or find it challenging to deal with conflicts, having a rental management service can act as a buffer and handle tenant interactions on your behalf.

Remember, rental management can offer numerous advantages, including professional expertise, reduced stress, better tenant retention, timely rent collection, property maintenance, and legal compliance. Weigh these factors against your specific situation to determine if rental management is the right choice for your commercial investment.

December 19, 2023:

Understanding

Mortgage Interest Rates

The Federal Reserve, also known as the Fed, derives interest rates through a process called monetary policy. The Fed's primary tool for influencing interest rates is the federal funds rate. This is the interest rate at which banks lend and borrow funds from each other overnight.

The Fed buys or sells government securities (bonds) in the open market. When the Federal Reserve sells bonds, various entities can buy them. These include commercial banks, investment banks, mutual funds, pension funds, and individual investors. The buyers are typically interested in investing in bonds to earn interest on income and diversify their investment portfolios.

When the FED buys bonds, it increases the money supply, which can lower interest rates. Conversely, when it sells bonds, it reduces the money supply, which can raise interest rates. The Federal Open Market Committee (FOMC), a committee within the Fed, sets the target range for the federal funds rate. They meet regularly to assess the state of the economy and determine whether any adjustments to the interest rate are necessary.

The Fed sets a discount rate, which is the interest rate at which banks can borrow funds directly from the Fed. By adjusting the discount rate, the FED can encourage or discourage banks from borrowing, which can influence overall interest rates.

The Fed establishes reserve requirements, which are the minimum amounts of funds that banks must hold in reserve against certain types of deposits. By changing these requirements, the FED can affect the amount of money banks have available to lend, which can impact interest rates.

The Fed also uses other tools, such as adjusting the discount rate (the interest rate at which banks can borrow directly from the Fed) and setting reserve requirements (the amount of money banks must hold in reserve). These tools can also impact interest rates indirectly.

Overall, it’s important to note that the Fed's decisions on interest rates are based on various economic indicators, such as inflation, employment levels, and economic growth. The goal is to maintain price stability and promote sustainable economic growth. With this article you can understand that the Fed’s decisions affect any money loaned by a lender, so when mortgage rates go up, so do car loans, boat loans, credit card interest etc.